The number of independents are declining as hotel brands steal a march. David Harris investigates why more than half of all serviced accommodation in the UK will soon be tagged with a corporate brand

It seems not a month goes by without a big name bringing out another brand or sub-brand. But why are the big groups doing this? Is it to fulfil the needs of different types of guest or the demands of owners and investors?

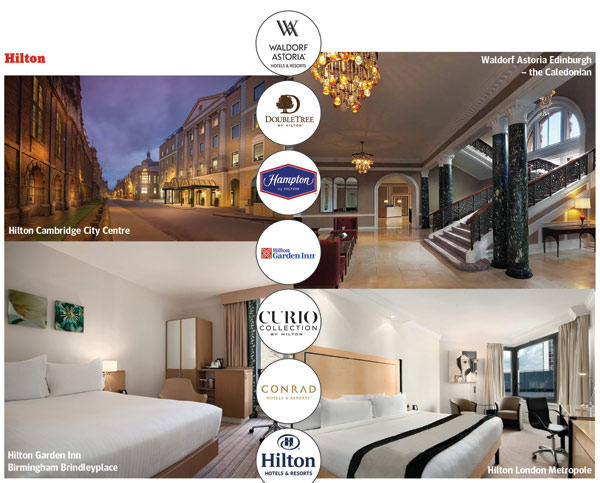

For the big hotel chains, scale seems to be vital. In February, Hilton indicated the extent of its expansion when it revealed that it has 174,000 hotel bedrooms under construction. Last year it opened 399 hotels with a total of nearly 60,000 rooms. In the UK it operates 144 hotels under seven different brand names.

Hotel consultant Melvyn Gold believes that investors are the driving force behind the proliferation of hotel brands. He argues that they often want a distinctive brand in their own city or area, so there is pressure on the big groups to be able to offer different options in order to achieve their expansion ambitions.

This in itself follows on from the way in which hotel companies have largely become dispensers of franchises and operators of management contracts, rather than owners of bricks and mortar. It is, in short, an inevitable development of the tendency of the established hotel groups to become "asset-light".

Gold says: "I don't think customers are demanding more hotel brands, nor do they understand the differences between the brands, but the hotel companies need to find these brands to fuel the development pipeline."

An obvious reason to adopt a brand of a big hotel company is so that hotel owners can have access to its reservations system. Branded hotels have a better chance of being full. Another reason, says Gold, is that the banks which lend money to hoteliers for development are much more likely to lend if it is going to be spent on a branded property.

Are guests left confused? Sometimes they are, says James Bland, director of hotels and hospitality at research consultancy BDRC Continental. He says: "In some cases it is confusing, and there are a number of brands that customers struggle to tell apart."

However, Bland dismisses the idea that this could lead to consolidation and fewer brands, as there are occasions when brand choice can work to the benefit of guests. He says: "The response of some groups to suggestions that two of its brands are similar is more likely to be to launch another one rather than consolidate, partly on the basis that their market research tells them that we all like to be treated as individuals."

In other words, if you think we have too many brands now, just wait and see how many we will have in 10 years' time. Gold estimates that by the end of 2017 corporate branded hotel supply in the UK had risen to 46.5% of total serviced accommodation, a figure that is predicted to rise to more than 60% by 2030.

Multiple choice

Diversity is another financial bonus for the big hotel companies having a large stable of brands. Bland says: "Groups like to have a collection of brands because they see it as an insurance against failure. It is seen as good to have a diverse portfolio of hotel brands in exactly the same way as investors are always advised to have a diverse portfolio of shares. If one brand becomes toxic, then the others will help. It is sensible portfolio management."

While Bland agrees that some hotel brands cause confusion for customers, he recognises that the three different types of Ibis hotels are well differentiated for guests.

AccorHotels, the owner of the Ibis name, will be pleased to hear that. The French group is keen to mount a strong defence of its brands. Karelle Lamouche, senior vice-president in sales and marketing, says: "With 10 brands in the UK, from luxury to economy, we really don't feel that is a lot. The customer knows the difference, and the reason we have different brands is based on guest requirements and behaviour." She adds that AccorHotels would not develop brands to please investors, because the group is focused on guests.

AccorHotels has also, arguably, done more to create a more varied portfolio by challenging disruptive accommodation providers head-on with its selection of home rental brands. This has involved the acquisition of the likes of Onefinestay, Squarebreak ("private homes with hotel services") and Oasis Collections ("home meets hotel").

AccorHotels has also attempted to make its hotels more unusual in a bid to offer something appealing to millennials. Notably, this includes the Jo&Joe brand, launched in 2016, which offers shared sleeping areas with private lockers, reading lights and USB ports, alongside yurts, hammocks and caravans. It was created by UK design house Penson. Not many of the big groups have been as brave as this, and AccorHotels' other brands, such as Mercure and Novotel, are more conventional.

For Hilton, its portfolio of 14 global brands aims to offer "a wide variety of hospitality experiences designed to meet the differing mind-sets and travel occasions of guests".

A spokesperson says: "We invest significant time and effort in identifying space for new brands. This ensures that our new brands are highly differentiated and resonate with both our relevant target guests and owners." IHG's plan seems to be to "evolve" its existing brands. Holiday Inn is undergoing what the group has described as its "biggest transformation in Europe in 20 years", with the front desk, bar, lounge and business centre combined into "one open and cohesive space".

IHG's venture into the more individual is probably best represented by its purchase in 2015 of Kimpton Hotels & Restaurants, which "fills the gap for those seeking a highly personal approach to boutique luxury". The notion of a personalised approach being offered by a big brand owned by a global group might seem like a contradiction in terms, but individualisation is part of the point of a hotel giant sub-dividing itself. None of the big companies intends to do anything other than continue, which suggests that Bland's prediction of brand expansion will prove true.

IHG's soon-to-be announced acquisition of a well-established brand will allow the company to combine the creativity of an independent with the reservation system of a global giant. It's the old story: a stylish independent injects new life into an established behemoth and in return gets a leg-up to the next level of commercial success. New ideas traded for reservation technology.

Different name, same vibe Everywhere you look in the hotel industry new brands are being established with a speed that seems to work against making each of them distinct from several others.

The launch language of each publicity campaign does little to help. Take Hilton's Tapestry Collection, announced last year, ostensibly to take advantage of a "white space opportunity" for a mid-market brand. The name, according to Hilton, was chosen because a "tapestry is a one-of-a-kind, woven piece of art, making it the ideal name for our new collection of hotels that are dedicated to being different".

December saw Rosewood Hotels launch Khos, a business hotel "with the style and vibrancy of a lifestyle hotel", whose facilities have been "re-imagined" to combine work and pleasure while on the road.

This attempt to combine an appeal to both business and leisure travellers does seem logical, if only in the sense that it expands the potential market. It is a widespread tactic, also used by one of this year's new launches, Zabeel House by Jumeirah. The group said in January that its hotels will be based in "lively" city neighbourhoods, targeting both business and leisure travellers. Presumably this means everybody, which is quite the target market.

Robin Hutson - an independent brand creator

The reason for this admiration is not hard to find. Hutson has a track record of creating successful, niche businesses with the Pig and Hotel du Vin. He was intimately involved with both from the start, and they are the sort of boutique successes that most major hotel companies would love to emulate.

Both companies offer personal touches and unique design features from the outset, but you won't find Hutson sneering at mainstream counterparts.

He says: "It's a complex world of brands and sub-brands, and there is now a place for everyone. If you come into a town and don't know the local scene, it's reassuring to stay at a Marriott or a Hilton."

But if you ask Hutson which mainstream brand he most admires, he struggles to answer. He acknowledges that being individual is a key part of how he functions in the hospitality business.

He says: "I always lean towards the independent. I know the big brands have created boutique sub-brands, but it doesn't quite work for me. Perhaps because a lot of the corporates put profit first, which is fundamentally different to the way independents operate.

"I try hard not to do anything that isn't commercially sound, but it's not the key driver. I aim to put the product and people first - both the guests and those who work at the hotels. If you get that right, profit follows."

View from the top: global chief executives are buzzing about brands

'Brands' was the buzzword at last week's International Hotel Investment Forum (IHIF) in Berlin, Germany, reports Katherine Price. The announcement from Keith Barr, chief executive of InterContinental Hotels Group, that an upscale conversion brand and a luxury brand will be revealed shortly, and Carlson Rezidor's rebrand as the Radisson Hotel Group and introduction of the premium Radisson Collection, were just a few of the headlines.

Federico GonzÁ¡lez, chairman of the Radisson Hotel Group, said the company had worked to clarify what each of the brands meant and what consumers will experience during their stay. He said the company is to have 20 Radisson Collection hotels on its books by 2020 (the group has already signed 14) and 500 of the group's 1,400 hotels will be rebranded or repositioned.

Thomas Dubaere, managing director of AccorHotels UK and Ireland, said his company will focus on expanding its Ibis Styles and Mercure brands in the UK in 2018 and expand the group's presence in the lifestyle hotel market. He said that as well as providing choice for guests and owners, brands are important to offer staff mobility and varying work environments.

"You do not have these opportunities if you do not have a good mix of brands and jobs and a good spread in different countries," he said. "The partners like to have a variety of brands in their portfolio. If we give them more brands, they will have more flexibility in converting whatever they have."

He believes there is room for innovative brands in the economy sector and "between midscale and upscale"; however, while design is important, the business has entered an era where people and experiences are most important, and new brands will go further to offer experiences.

During a conversation on brands between the world's leading CEOs, AccorHotels' chief executive Sébastien Bazin said: "Whether you have too many brands does not matter - make sure you differentiate between each."

Keith Barr, chief executive of IHG, explained that the group's recently launched midscale Avid brand will be the company's "next Holiday Inn" in terms of volume. Some 75 properties have been signed to the brand.

Christopher Nassetta, chief executive of Hilton, said the company's newest brands have all been about satisfying the needs of existing customers that its current brands are not satisfying, as well as attracting new guests. He said that Tru by Hilton will probably be its most impactful brand over the next few years and that the company is in a "constant state of reinvention" with all its existing brands.

Continue reading

You need to be a premium member to view this. Subscribe from just 99p per week.

Already subscribed? Log In